YOUR PERSONAL TEAM LOOKING OUT FOR YOUR INTERESTS

OVER 260 SEATTLE AREA REAL ESTATE TRANSACTIONS

LET US GUIDE YOU IN BUYING YOUR NEXT HOME

Our process can be summarized as

We guide the process, you control the decisions.

We strongly believe in empowering our buyers to be fully educated on the market and what the offer entails.

Advising you before the transaction, we will make sure you understand all the terms, processes and documents involved. We’ll provide real-time market data and helpful information so you can make informed decisions.

You can be confident you have skilled negotiators working on your behalf and be assured that all action items and communications are being handled thoughtfully and professionally.

Buying a home in Seattle can be a challenge, we make it easier.

GETTING TO KNOW YOU

Before we can help you buy a home, we’ll need to know a few things about you. The first meeting is a chance for us to get to know each other and learn how we can help you achieve your goals. We will want to hear your unique story.

We will also go over the buying process, the current market, and how our system will get you there. This initial conversation is not about which floor plans you prefer or what your budget might be—it’s purely to get to know you and help you understand what the buying process looks like with us.

Our practice is built on relationships, so it’s important to build a foundation of trust and transparency as we move forward. We’ll help you dig deeper into your home search criteria and search tools at a second meeting after

we’ve begun the process

A bit about you

Goals and timelines

Current marketplace

Market trends and seasonality

Buying process

Your needs and expectations

QUESTIONS WHEN STARTING YOUR HOME SEARCH

How long do you see yourself living in your home?

What features are most important to you in a home?

What neighborhoods and home styles within your budget attract you the most?

What is your commute tolerance?

Do you have any specific lifestyle factors that your home must accommodate now?

Considering any family or roommates, is your household likely to stay the same size?

What parts of Seattle are you interested in Buying a home in?

Once you’ve determined your budget and we have an idea of what you’re looking for, you’ll start your home search.

This process will help you get a sense of what you can expect from different types of homes, your price point and the vibe of various neighborhoods.

It will also help us get a better sense of your wants and needs in order to continue refining your search. Here are some more considerations about buying a home in seattle

UNDERSTANDING FINANCING

PRE-QUALIFICATION

Work with a local lender to review finances and make a determination of the probability of obtaining a loan. A local lender is important as they know the local market.

PERFORMANCE GUARANTEE

Lender certification of your ability to be issued a loan based on a combination of your financial profile and the proposed purchase price of the subject property.

PRE-APPROVAL

Lender verification of your income and credit approval. Obtaining pre-approval early in the process can give you and the seller greater confidence in your ability to close on the purchase.

CASH BUYER

Ability to purchase the home based on verified cash holdings

rather than lender financing

What not to do when borrowing money

Omit debts or liabilities from your application

Buy big-ticket items (such as furniture)

Change bank accounts

Co-sign a loan for anyone

Change marital status

Co-sign a loan for anyone

Change marital status

What not to do when borrowing money

Change jobs, become self-employed or quit your job

Buy a car, truck, motorcycle or van

Use credit cards more than normal

Stop paying bills

Spend money you have saved for closing

Originate any inquiries into your credit

Make large cash deposits without checking with your loan officer

START TOURING

Now it’s time to explore the market in earnest. We’ll help you find listings to visit that meet your needs and spark your interest.

During this time, we’ll look at a variety of listings with you, including viewing some online, driving by certain listings and touring the most promising properties in person.

There is no right or wrong number of listings to view, nor is there a specific timeline you have to stick to during the search.

To help you be confident in your selection, we will lay out the pros and cons of each contending property.

Our advice will always be honest and backed up by relevant data.

When you are looking for a primary residence, we’ll ask you how well you know the neighborhoods where you’re searching.

If you’re moving to a new area, we advise you to spend time there, exploring the community and seeing what you like about it.

There are hidden gems in every neighborhood, and we want you to find the one that you mesh with.

DUE DILIGENCE

HOME INSPECTIONS

PRE-INSPECTIONS

In a competitive market, sellers will look for offers with the fewest contingencies, including inspections. It’s possible the seller may have completed their own home inspection, which will be available to buyers. (Sometimes the inspection report may only be available after you’ve toured the home.)

The inspection will allow you to understand the condition of the house and its systems prior to making an offer. Sometimes the seller has not completed their own inspection. In this case, we will hire a professional to complete a pre-inspection of the house, allowing you to write the most competitive offer possible

PUTTING TOGETHER YOUR OFFER

WINNING OFFER STRATEGIES

PRICE & ESCALATION

EARNEST MONEY

In a multiple-offer situation, it may be prudent to offer a price-escalation provision—or escalator clause— to strengthen your offer against competing offers. To do this correctly and confidently, you’ll need to know your uppermost price tolerance for the purchase. At that point you’ll discuss how an escalator can help your offer stand out, as well as any tactics that might minimize the chances a bidding war will escalate to your maximum budget.

Any offer you make will require you to commit a certain dollar amount as a good faith deposit. In a competitive situation, the more earnest money you can commit, the more your offer may stand out to the seller. Another tactic is authorizing escrow to convert earnest money into a nonrefundable deposit upon offer acceptance. Depending on the level of buyer interest in the listing, we may discuss the benefits of such a maneuver and your tolerance for making it.

CONTINGENCIES

When we submit an offer on a listing that is expected to receive competing offers, we’ll discuss the pros and cons of waiving certain contingencies. These include the inspection, financing, appraisal and title contingencies. We’ll counsel you about the impact of each contingency and the risks associated with waiving them.

TIMING

In a competitive scenario, it may also help to offer a specific closing timeline if that’s meaningful to the seller. A favorable rentback provision may also appeal to the seller so they have more time to vacate the property. Either way, we will work to ascertain the seller’s preferences before we write the offer.

PURCHASE & SALE AGREEMENT

The Purchase & Sale Agreement Usually Consists of the Following

Earnest money declaration

Financing addendum

Inspection addendum

Optional Clauses addendum (Form 22D)

Addendum outlining special conditions (WRE41)

Lead-based paint notification, when appropriate

FIRPTA (Form 22E)

Title review

SETTLEMENT & CLOSING

The Buyer Pays For

Prorated property taxes (from date of acquisition)

Prorated Homeowners Association dues (from date of acquisition) if applicable

Recording fees for all documents in buyer’s name

Notary fees, if applicable

Homeowner’s hazard insurance premium for first year

Inspection fees (according to contract)

Loan fees as agreed with lender

Interim interest on new loan, prorated from date of funding to first payment date

The Seller Pay For

Seller’s escrow fee (according to contract)

Owner’s title insurance premium

Real estate service fees (according to contract)

Payoff of all encumbrances (loans) in seller’s name

Prorated property taxes (prior to date of sale)

Any judgments, tax liens, assessments or encumbrances placed against property title

Any unpaid Homeowners Association dues

Recording charges to clear all documents of record against the seller

Excise tax, if applicable, determined by county and based on sale price

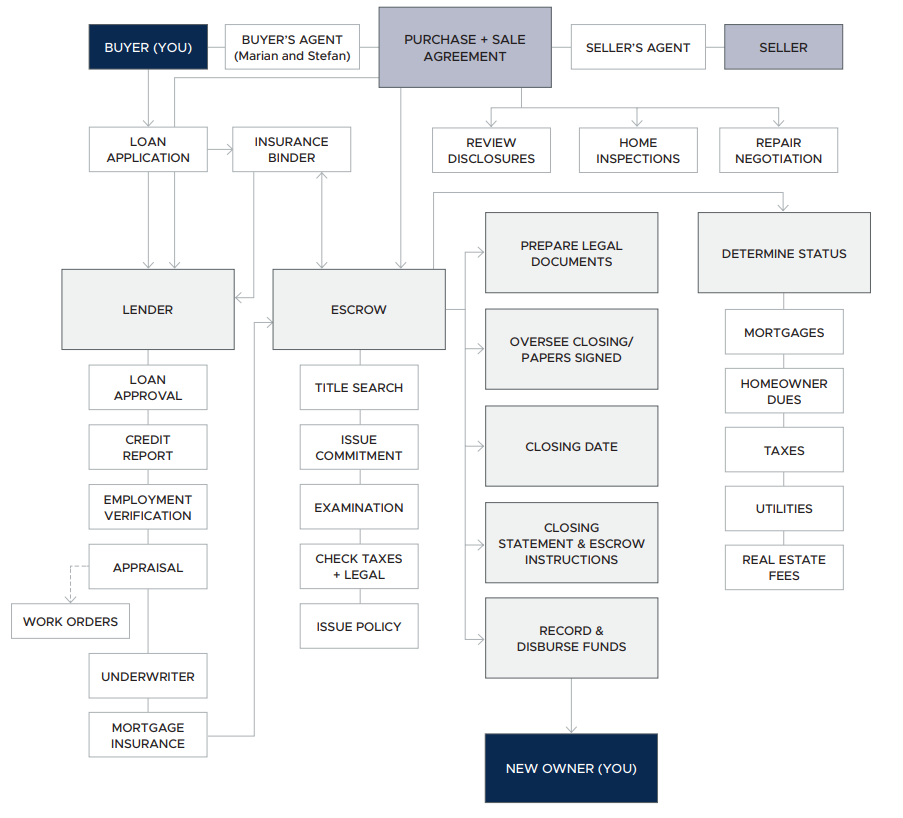

THE PATH TO CLOSING

HANDING OFF KEYS

Congrats on buying a home in Seattle! We’re thrilled to have been part of your journey. As full-service brokers, we provide lifetime support to our clients.

From here on out, consider us your go-to resource for all your home ownership questions. We can provide referrals for trusted contractors, landscapers, cleaners and anything else you might need.

And, when the time is right, we’ll be right here if and when you need to sell your home and get ready for the next adventure.